|

This law means millions of Americans across all 50 states, U.S. territories, and the District of Columbia will save money from meaningful benefits. The Inflation Reduction Act is accomplishing the following just one year after being enacted:

|

||||||

Medicare Blog | Medicare News | Medicare Information

Inflation Reduction Act: Update on CMS Implementation

Posted by www.psmbrokerage.com Admin on Mon, Aug 28, 2023 @ 10:40 AM

Tags: Medicare Advantage, Medicare Supplement, Medicare Part D, CMS

Introducing AdvantageGuard: A New Hospital indemnity Plan

Posted by www.psmbrokerage.com Admin on Thu, Aug 10, 2023 @ 12:12 PM

|

AdvantageGuard offers broad, customizable solutions for clients seeking easy and reliable hospital indemnity coverage. With guaranteed issue coverage options for seniors aged 60-741 and a focus on flexibility and affordability, AdvantageGuard makes it easy to find the help they may need with unexpected costs. Clients can choose the benefits that best fit their needs and budget, all backed by a insurer with an "A+" AM Best rating2. AdvantageGuard offers convenient cash benefits paid to the insured, making it a smart choice for clients who want help with covering out-of-pocket expenses, like their Medicare Advantage plan copays.

If you would like to get contracted to sell AdvantageGuard or other Golden Rule Insurance Company products, click here to get started. Precision Senior Marketing is an independent broker agency offering plans underwritten by Golden Rule Insurance Company and other insurers.

212-month Commission Advance is only available through YourFMO.com, LLC. contract 3Payable per day (limits apply) when Insured Person receives a prescription delivered by injection in an outpatient provider setting. 4Ratings as of 12/09/2022. This worldwide, independent organization reviews insurance companies and other businesses and publishes opinions about them. This rating is an indication of financial strength and stability. For the latest rating, access www.ambest.com. 49985-G-0723 Agents Only. Not Intended For Consumer Use.

|

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: Hospital Indemnity, Medicare Advantage, AEP

2024 Aetna Medicare Retail Program

Posted by www.psmbrokerage.com Admin on Fri, Aug 04, 2023 @ 12:02 PM

|

The goal of a retail program is to reach and engage potential Medicare beneficiaries in person, allowing them to learn about Medicare Advantage plans, ask questions, and enroll in a plan on the spot. Retail programs can be particularly effective in areas with a significant senior population and in locations where there is a higher demand for face-to-face interactions. Why Participate? YEAR-ROUND LEADS! Opportunity to work together in building a “Prospect Pipeline” to increase sales year-round. Shopper Traffic - Access to high-traffic retail locations that can drive leads and sales. Low Cost - Cost-efficient retail bundles that are competitively priced. Competitive Program - Program requirements that are more relaxed. Simple Tools - Use ThinkAgent to verify and track schedules and manage leads. Helpful Training - Our training resources and tips help prepare and master retail.

Retail programs can be an effective marketing and sales channel for agents, complementing other methods such as direct mail, online advertising, and telephonic sales. The success of the program depends on the agent's ability to target the right locations and provide a positive and informative experience for potential beneficiaries. |

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, aetna, AEP, Retail Program

Discover an unparalleled array of valuable resources tailored exclusively for insurance agents

Posted by www.psmbrokerage.com Admin on Mon, Jul 31, 2023 @ 11:08 AM

|

Discover an unparalleled array of valuable resources tailored exclusively for insurance agents serving the senior market. At PSM, we are dedicated to equipping agents with the knowledge and tools they need to excel in this specialized field. From comprehensive educational materials on Medicare to interactive training sessions on sales strategies and compliance, our goal to empower agents with the latest industry insights. Join our vibrant community and benefit from networking opportunities to foster professional growth. Experience the difference with PSM, where agents can elevate their expertise and better serve their senior clients. Sample Guides: |

||

| Newest Blog Posts | All Blog Posts |

Tags: Final Expense, Medicare Advantage, Medicare Supplement, Professional Networking, Guide, Resources

Retail Program Opportunities for AEP

Posted by www.psmbrokerage.com Admin on Thu, Jul 27, 2023 @ 01:49 PM

|

The goal of a retail program is to reach and engage potential Medicare beneficiaries in person, allowing them to learn about Medicare Advantage plans, ask questions, and enroll in a plan on the spot. Retail programs can be particularly effective in areas with a significant senior population and in locations where there is a higher demand for face-to-face interactions. If you think you would be a good candidate and would like to participate, please request details here, or give us a call at 800-998-7715. Retail programs can be an effective marketing and sales channel for agents, complementing other methods such as direct mail, online advertising, and telephonic sales. The success of the program depends on the agent's ability to target the right locations and provide a positive and informative experience for potential beneficiaries. |

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, AEP, Retail Program

Aetna Medicare Advantage First Look 2024: Opportunities await!

Posted by www.psmbrokerage.com Admin on Wed, Jul 26, 2023 @ 09:10 AM

|

We're excited to share details about our 2024 AEP strategy! Call us today for details: 800-998-7715 |

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: Medicare Advantage, aetna, First Looks, 2024

YourFMO SunFire: New MAPD Enrollment Form Training Video

Posted by www.psmbrokerage.com Admin on Tue, Jul 25, 2023 @ 02:00 PM

|

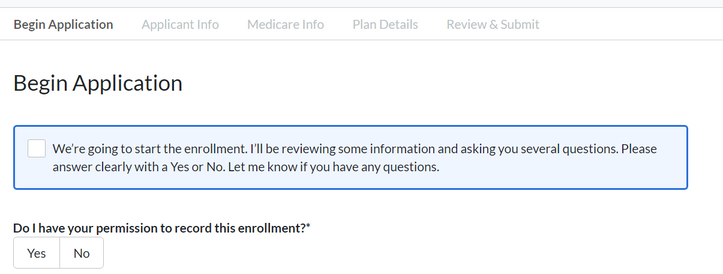

Medicare Advantage Update Enrollment Form Updates SunFire has completely redesigned their Medicare Advantage enrollment forms, incorporating the latest compliance requirements plus several workflow enhancements, creating the most intuitive and compliant enrollment experience possible for agents and the customers they serve. Watch the new training video here. Highlights of the new MAPD forms include:

Key Dates

Sneak Preview

Independent agents play a vital role in helping seniors secure the most cost-effective Medicare plans for their individual needs. This comprehensive tool simplifies the sales process with multi-carrier shopping and enrollment platforms wrapped into a single online experience. And best of all, this platform is available at no cost to PSM agents. Request details today and make sure you have access to this cutting edge technology at your fingertips.

|

|||

| Newest Blog Posts | All Blog Posts | |||

New Strategic Alliance with Mutual of Omaha and Wellcare

Posted by www.psmbrokerage.com Admin on Fri, Jul 21, 2023 @ 09:09 AM

|

Two leaders in the senior health market- Mutual of Omaha and Wellcare have formed a strategic alliance to offer jointly designed Medicare Advantage plans in select markets for the 2024 plan year. As a customer-focused company, Mutual of Omaha is committed to offering a comprehensive suite of senior health products. Medicare Advantage plans offered with Wellcare are a meaningful addition to our portfolio of senior health solutions designed to meet customers' individual needs. A trusted brand among seniors with 95% brand awareness, Mutual of Omaha is the nation's second-largest provider of Medicare Supplement plans. Our company remains committed to the Medicare Supplement market and plan to continue to grow in this space. Our senior health solutions portfolio also includes prescription drug (Part D), dental and vision coverages. Wellcare and Mutual of Omaha will offer No Premium and Low Premium MAPD PPO cobranded plans in Georgia, Missouri, South Carolina, and Washington state as well as in Dallas/Fort Worth and Houston markets in Texas. The jointly marketed plans will be offered during this fall's Medicare Annual Enrollment Period (AEP) which begins Oct. 15 and runs through Dec. 7th. The customer experience, including customer service, enrollment, and member communications, will be the Wellcare experience. All sales and brokerage operations will be handled by Wellcare. All 2024 contracted and certified Wellcare brokers will automatically have access to the co-branded plans with the same compensation model. We are excited to offer this new opportunity to you and your clients. Be on the lookout for more information as we showcase the plans and the opportunities in each market. |

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, Mutual of Omaha Medicare Supplement, dental plans, WellCare

Humana Medicare Advantage 2024 First Look

Posted by www.psmbrokerage.com Admin on Wed, Jul 19, 2023 @ 09:17 AM

|

Humana 2024 First Look is now available This just in! The 2024 Humana first looks website just went live! We're excited to share details about their 2024 AEP strategy! Call us today for details: 800-998-7715. Now appointed with Humana Medicare Advantage? Request details here.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Humana, Medicare Advantage, First Looks, 2024

Savvy Agents Can Expand Their Medicare Business Cross-Selling Ancillary Products

Posted by www.psmbrokerage.com Admin on Tue, Jul 18, 2023 @ 09:17 AM

|

Insurance agents can have successful careers building a significant client base by selling Medicare Advantage (MA) coverage to beneficiaries. Agents wanting to expand their business beyond MA coverage and move their earnings to new levels can do that holistically with ancillary products. Along with the potential for increased revenue, agents cross-selling ancillary products could help their clients save money on health care expenses while setting themselves apart from the competition. One cross-selling technique is packaging MA and ancillary products as a bundled approach. This minimizes the likelihood of clients seeking alternative coverage options, It’s important to remember that cross selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non health related product (such as life or home insurance or financial planning services). This activity is prohibited during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials (such as the “Enrollment Guide”) to consumers. Let’s breakdown the three most popular ancillary products. HOSPITAL INDEMNITY PLANS Hospital Indemnity (HI) plans provide Medicare beneficiaries with financial protection for medical expenses associated with daily hospital confinement, ambulance rides, diagnostic tests, lab work and prescription medications. Agents can share with clients that the plans are designed to supplement other health insurance policies and can cover deductibles, copayments and other out-of-pocket costs. HI policies don't have network restrictions, meaning policyholders can choose providers that are both in and out-of-network. Networks become very important, especially when a person wants treatment at the best facility available after a diagnosis of a critical or complex disease, such as cancer, renal failure or heart disease. An added benefit: many HI plans come with riders, such as coverage for cancer costs, emergency room visits and outpatient services. FINAL EXPENSE PLANS Final Expense (FE) policies provide clients with a sense of security for their loved ones and protect them from unforeseen costs associated with medical bills and funeral costs. With the right guidance and product knowledge, agents can provide their customers Agents can also stress that FE products go beyond burial costs and can include leaving financial gifts for clients’ family members that can go to settling debts. DENTAL, VISION AND HEARING (DVH) PLANS Dental, Vision and Hearing (DVH) coverage can increase a client’s financial protection TAKING ADVANTAGE OF THE ANCILLARY MARKETPLACE The ancillary marketplace lets agents leverage their already-existing client base and build longer-term relationships with them through cross-selling opportunities. Once agents are comfortable with selling MA products, they can take the following steps to move into the ancillary marketplace:

“Cross-selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non-health related product (such as life or home insurance or financial planning services). This activity is prohibited by CMS during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials to consumers. Review the current Medicare Advantage Marketing Regulations and make sure you’re complying with Medicare’s rules regarding cross-selling.” *For Agent use only. Not affiliated with the U. S. government or federal Medicare program.

RESOURCES:

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Final Expense, Hospital Indemnity, Medicare Advantage, cross marketing, dental plans