|

The goal of a retail program is to reach and engage potential Medicare beneficiaries in person, allowing them to learn about Medicare Advantage plans, ask questions, and enroll in a plan on the spot. Retail programs can be particularly effective in areas with a significant senior population and in locations where there is a higher demand for face-to-face interactions. If you think you would be a good candidate and would like to participate, please request details here, or give us a call at 800-998-7715. Retail programs can be an effective marketing and sales channel for agents, complementing other methods such as direct mail, online advertising, and telephonic sales. The success of the program depends on the agent's ability to target the right locations and provide a positive and informative experience for potential beneficiaries. |

||

| Newest Blog Posts | All Blog Posts |

Medicare Blog | Medicare News | Medicare Information

Retail Program Opportunities for AEP

Posted by www.psmbrokerage.com Admin on Thu, Jul 27, 2023 @ 01:49 PM

Tags: Medicare Advantage, AEP, Retail Program

Aetna Medicare Advantage First Look 2024: Opportunities await!

Posted by www.psmbrokerage.com Admin on Wed, Jul 26, 2023 @ 09:10 AM

|

We're excited to share details about our 2024 AEP strategy! Call us today for details: 800-998-7715 |

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: Medicare Advantage, aetna, First Looks, 2024

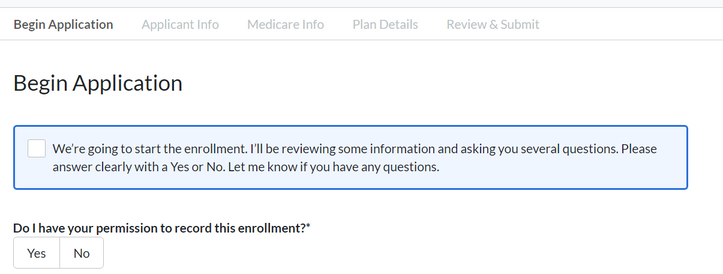

YourFMO SunFire: New MAPD Enrollment Form Training Video

Posted by www.psmbrokerage.com Admin on Tue, Jul 25, 2023 @ 02:00 PM

|

Medicare Advantage Update Enrollment Form Updates SunFire has completely redesigned their Medicare Advantage enrollment forms, incorporating the latest compliance requirements plus several workflow enhancements, creating the most intuitive and compliant enrollment experience possible for agents and the customers they serve. Watch the new training video here. Highlights of the new MAPD forms include:

Key Dates

Sneak Preview

Independent agents play a vital role in helping seniors secure the most cost-effective Medicare plans for their individual needs. This comprehensive tool simplifies the sales process with multi-carrier shopping and enrollment platforms wrapped into a single online experience. And best of all, this platform is available at no cost to PSM agents. Request details today and make sure you have access to this cutting edge technology at your fingertips.

|

|||

| Newest Blog Posts | All Blog Posts | |||

New Strategic Alliance with Mutual of Omaha and Wellcare

Posted by www.psmbrokerage.com Admin on Fri, Jul 21, 2023 @ 09:09 AM

|

Two leaders in the senior health market- Mutual of Omaha and Wellcare have formed a strategic alliance to offer jointly designed Medicare Advantage plans in select markets for the 2024 plan year. As a customer-focused company, Mutual of Omaha is committed to offering a comprehensive suite of senior health products. Medicare Advantage plans offered with Wellcare are a meaningful addition to our portfolio of senior health solutions designed to meet customers' individual needs. A trusted brand among seniors with 95% brand awareness, Mutual of Omaha is the nation's second-largest provider of Medicare Supplement plans. Our company remains committed to the Medicare Supplement market and plan to continue to grow in this space. Our senior health solutions portfolio also includes prescription drug (Part D), dental and vision coverages. Wellcare and Mutual of Omaha will offer No Premium and Low Premium MAPD PPO cobranded plans in Georgia, Missouri, South Carolina, and Washington state as well as in Dallas/Fort Worth and Houston markets in Texas. The jointly marketed plans will be offered during this fall's Medicare Annual Enrollment Period (AEP) which begins Oct. 15 and runs through Dec. 7th. The customer experience, including customer service, enrollment, and member communications, will be the Wellcare experience. All sales and brokerage operations will be handled by Wellcare. All 2024 contracted and certified Wellcare brokers will automatically have access to the co-branded plans with the same compensation model. We are excited to offer this new opportunity to you and your clients. Be on the lookout for more information as we showcase the plans and the opportunities in each market. |

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, Mutual of Omaha Medicare Supplement, dental plans, WellCare

Humana Medicare Advantage 2024 First Look

Posted by www.psmbrokerage.com Admin on Wed, Jul 19, 2023 @ 09:17 AM

|

Humana 2024 First Look is now available This just in! The 2024 Humana first looks website just went live! We're excited to share details about their 2024 AEP strategy! Call us today for details: 800-998-7715. Now appointed with Humana Medicare Advantage? Request details here.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Humana, Medicare Advantage, First Looks, 2024

Savvy Agents Can Expand Their Medicare Business Cross-Selling Ancillary Products

Posted by www.psmbrokerage.com Admin on Tue, Jul 18, 2023 @ 09:17 AM

|

Insurance agents can have successful careers building a significant client base by selling Medicare Advantage (MA) coverage to beneficiaries. Agents wanting to expand their business beyond MA coverage and move their earnings to new levels can do that holistically with ancillary products. Along with the potential for increased revenue, agents cross-selling ancillary products could help their clients save money on health care expenses while setting themselves apart from the competition. One cross-selling technique is packaging MA and ancillary products as a bundled approach. This minimizes the likelihood of clients seeking alternative coverage options, It’s important to remember that cross selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non health related product (such as life or home insurance or financial planning services). This activity is prohibited during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials (such as the “Enrollment Guide”) to consumers. Let’s breakdown the three most popular ancillary products. HOSPITAL INDEMNITY PLANS Hospital Indemnity (HI) plans provide Medicare beneficiaries with financial protection for medical expenses associated with daily hospital confinement, ambulance rides, diagnostic tests, lab work and prescription medications. Agents can share with clients that the plans are designed to supplement other health insurance policies and can cover deductibles, copayments and other out-of-pocket costs. HI policies don't have network restrictions, meaning policyholders can choose providers that are both in and out-of-network. Networks become very important, especially when a person wants treatment at the best facility available after a diagnosis of a critical or complex disease, such as cancer, renal failure or heart disease. An added benefit: many HI plans come with riders, such as coverage for cancer costs, emergency room visits and outpatient services. FINAL EXPENSE PLANS Final Expense (FE) policies provide clients with a sense of security for their loved ones and protect them from unforeseen costs associated with medical bills and funeral costs. With the right guidance and product knowledge, agents can provide their customers Agents can also stress that FE products go beyond burial costs and can include leaving financial gifts for clients’ family members that can go to settling debts. DENTAL, VISION AND HEARING (DVH) PLANS Dental, Vision and Hearing (DVH) coverage can increase a client’s financial protection TAKING ADVANTAGE OF THE ANCILLARY MARKETPLACE The ancillary marketplace lets agents leverage their already-existing client base and build longer-term relationships with them through cross-selling opportunities. Once agents are comfortable with selling MA products, they can take the following steps to move into the ancillary marketplace:

“Cross-selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non-health related product (such as life or home insurance or financial planning services). This activity is prohibited by CMS during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials to consumers. Review the current Medicare Advantage Marketing Regulations and make sure you’re complying with Medicare’s rules regarding cross-selling.” *For Agent use only. Not affiliated with the U. S. government or federal Medicare program.

RESOURCES:

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Final Expense, Hospital Indemnity, Medicare Advantage, cross marketing, dental plans

|

July 7 marked 100 days until the start of Medicare's Annual Enrollment Period – affectionally known as AEP – and it's time to get excited! With new rules and regulations from CMS taking affect and new carrier products to learn and master, it's important that all of us to stay up to date and think through our collective strategies. According to recent statistics, more than 30 million Americans are enrolled in Medicare Advantage plans, making them eligible to sign up or renew their coverage during this AEP and start their new Medicare benefits on Jan. 1, 2024. The best way to stay informed and prepared for the upcoming enrollment period is through research and leaning in to all the available resources at your fingertips. Make sure to review the new CMS rules and regulations as they are released and familiarize Get to know the Medicare products you are selling! Become knowledgeable about the benefits of the different plans available, rate changes heading into 2024, and competitiveness of the offerings in the areas you serve. Check out the new 2024 Medicare Advantage and Part D Rate Announcement Fact Sheet and the 2024 Medicare Advantage and Part D Final Rule – both available on the CMS.gov website. Now is the time to reconnect with key clients ahead of the AEP 2024 selling season. Take At the same time, now is also the time to start strategizing for how you’ll achieve your objectives this AEP, noting the important role this selling season plays in setting the tone for the new year. It starts with recruiting and certifications, and then fleshing out your game plan for how you’ll drive productivity throughout the AEP selling season. Figure out which platforms you want to use, create and organize your promotional materials and plan out how you’ll drive activity. Doing this ahead of time will ensure that you are well prepared when the enrollment period begins. And don’t forget about our AEP Resource Page as your one-stop shop. We are prepared to help you execute your AEP objectives The complexity of the AEP process and the everchanging landscape of health care requires a comprehensive understanding of different types of plans and coverage options, timelines, and deadlines associated with AEP. Preparing your team for AEP is key! PSM’s approach - crafted and fine-tuned - takes a holistic approach to insurance distribution, one that allows us to create tailored partnership models with our agents and financial professionals and their affiliated companies to deliver what they and their clients need. This includes a product portfolio of the nation’s best health and wealth solutions designed to meet the needs of consumers’ health and financial wellbeing, no matter where they are on their retirement journey. The start of Medicare’s Annual Enrollment Period is just around the corner, and the time to prepare is now. Research the new rules and regulations, familiarize yourself with the different plans, and map out strategies that align with your goals. With the support and preparation from your PSM team, you will be ready and excited to help your clients make the best choices to live a happy, healthy retirement. The AEP is right around the corner and there are some exciting opportunities on the horizon for 2024. Get prepared early to ensure a successful Annual Enrollment Period. We are here to help!

|

||||

| Newest Blog Posts | All Blog Posts | ||||

Tags: Online Enrollment, Medicare Advantage, CMS, AEP, Compliance, 2024, Resources

The New 60/40: Replacing Bonds with Fixed Indexed Annuities

Posted by www.psmbrokerage.com Admin on Mon, Jul 17, 2023 @ 03:16 PM

|

Financial market upheavals and bank instability have left Americans feeling uncertain about the safety of their money. Recent failures of large banks have had a mobilizing effect on investors nationwide. American consumers, now fearful of depositing money into their once-trusted bank accounts, are in search of safe havens for their money.But it wasn’t just the recent banking failures that caused concern. As the Federal Reserve raised interest rates, banks didn't do the same for depositors. Deposits overall had been in a steady decline over the past year. Combined with rising interest rates, less competitive investment rates for bank accounts offering next to nothing returns and the fear of further failures, many people have decided to park their money elsewhere.Fortunately, there are ways to protect and grow your clients’ hard-earned and astutely saved assets without taking on too much risk: Replacing volatile traditional bank bonds with more durable and dependable fixed indexed annuities (FIA).FIAs pay an interest rate based on the performance of a market index, such as the S&P 500. However, money isn't invested or exposed to the market. It’s a blend of other annuity types and applies beneficial elements of each. The FIA offers the protection of a fixed annuity with the potential for growth like the index annuity.What is the old 60/40? The old 60/40 portfolio is a 71-year-old investment strategy, first proposed by Nobel Laureate Harry Markowitz in 1952. The strategy involves investing 60% of a portfolio in stocks and 40% in bonds. It's an easy-to-follow approach to diversifying investments — but it comes with a significant amount of market risk. The 60/40 has been popular for decades, but with recent changes in the financial landscape, it may be time to rethink our strategy. In “The New 60/40,” you’re replacing bonds with FIAs, which can offer more market protection and more robust growth opportunities. For example, whereas bank CDs carry a 3% to 10% financial reserve, FIAs are a 100% financial reserve product, which allows investors to access all their funds at any time, without any restrictions or limitations. Being a 100% financial reserve product allows investors to keep their funds in a safe, secure and liquid form, while still earning an attractive return. A 100% financial reserve product offers investors the ability to access their funds immediately and with no hidden costs or fees. FIAs can help clients protect their principal and generate market-like gains without financial market risk. They can help to generate important retirement income without having to withdraw funds from the growth portion of a portfolio. This makes FIAs an attractive option for those looking to protect their retirement savings and build income.

Remember, selling fixed annuities involves working with individuals' financial well-being, so it's crucial to act ethically, provide accurate information, and always prioritize the best interests of your clients. You can review our Annuity Product Portfolio here. You can also call us at 800-998-7715 and speak with one of our marketing representatives to assist with any questions.

|

||||

| Newest Blog Posts | All Blog Posts | ||||

Marketing Masterminds: Unlock qualified leads that call YOU

Posted by www.psmbrokerage.com Admin on Mon, Jul 17, 2023 @ 12:58 PM

Check out the latest Marketing Masterminds webinar to learn how our direct qualified leads can help you win big this AEP. Recorded webinar link available here.

Marketing Masterminds: Mastering Inbound Calls with LeadStar Marketplace William and Megan discuss the need to launch campaigns on a monthly basis and the benefits of using the Lead Star marketplace for inbound calls, highlighting cost savings for agents and agencies. They also highlight the platform's performance for Medicare data leads, with a better than average CPA. Recorded webinar link available here. |

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: CMS, Compliance, LeadStar, Medicare leads

Impacts of the 2024 CMS Final Rule

Posted by www.psmbrokerage.com Admin on Mon, Jul 17, 2023 @ 12:39 PM

|

Before we dive in, it's crucial not to solely depend on these key points, as they are only a portion of the overall impact. We strongly advise reviewing the regulation and guidance thoroughly in order to gain a comprehensive understanding of each requirement and the potential changes you may need to implement. Also, be sure to visit https://yourfmo.com/cms-faqs which is frequently updated as we receive guidance from CMS and our carrier partners. Sales and Marketing Activities

Marketing Materials

For Agent Use Only.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, CMS, Compliance