|

Another great annual Medicare Summit in the books!A special thanks to NABIP Texas, Danielle Kunkle Roberts, and Dana Lasman, Medicare Benefits Specialist for orchestrating such a worthwhile event.Appreciate all the hard-working and passionate independent agents who attended and help support the ever-important NABIP cause. Precision Senior Marketing, as a proud sponsor, hopes you enjoyed the content and can put some of those concepts into action to ensure you have the most successful AEP ever!

About NABIP National Association of Benefits and Insurance Professionals Texas Chapter (NABIP-TX) is a state member of the National Association of Benefits and Insurance Professionals (NABIP). We are a professional organization of agents and insurance company representatives who care enough about their clients to join together with a Mission Statement "...to inform and protect the consumer by enhancing the professional growth of its members." NABIP represents nearly 20,000 professional health insurance agents and brokers who service the insurance needs of millions of Americans. Founded in 1930, there are now 200 state and local chapters in the United States.

|

||||

Medicare Blog | Medicare News | Medicare Information

NABIP Texas - Annual Medicare Summit Recap

Posted by www.psmbrokerage.com Admin on Mon, Aug 28, 2023 @ 01:55 PM

|

|

Inflation Reduction Act: Update on CMS Implementation

Posted by www.psmbrokerage.com Admin on Mon, Aug 28, 2023 @ 10:40 AM

|

This law means millions of Americans across all 50 states, U.S. territories, and the District of Columbia will save money from meaningful benefits. The Inflation Reduction Act is accomplishing the following just one year after being enacted:

|

||||||

Tags: Medicare Advantage, Medicare Supplement, Medicare Part D, CMS

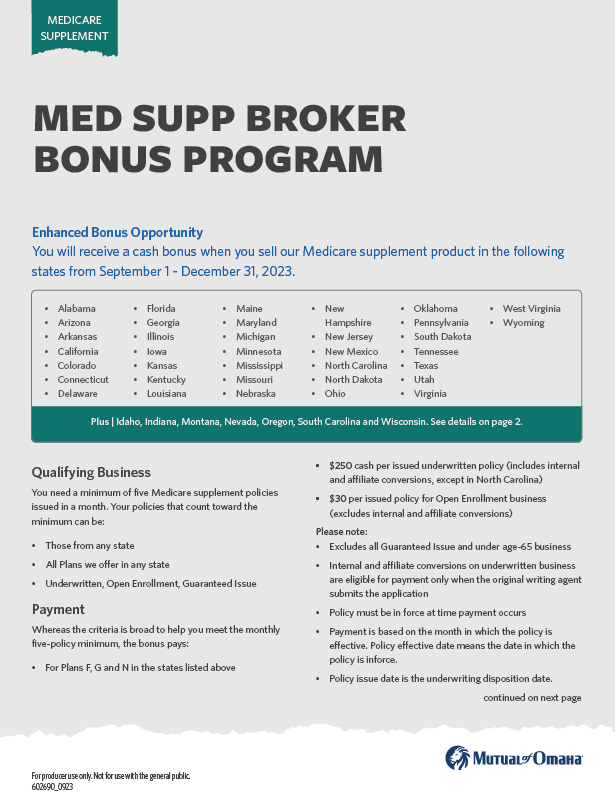

Mutual of Omaha: Enhanced Med Supp Broker Bonus Program

Posted by www.psmbrokerage.com Admin on Mon, Aug 28, 2023 @ 09:52 AM

|

Not appointed to sell with Mutual of Omaha? Request details today and add this great company to your portfolio.

|

||

| Newest Blog Posts | All Blog Posts |

Navigating Success: Best Practices When Selling Medicare Insurance to Seniors

Posted by www.psmbrokerage.com Admin on Mon, Aug 14, 2023 @ 01:21 PM

|

Selling Medicare insurance to seniors is a significant responsibility that requires a delicate balance of understanding, empathy, and expertise. As seniors approach retirement and healthcare becomes a central concern, your role in guiding them through their Medicare options is invaluable. To excel in this field, here are essential best practices to consider: 1. In-Depth Knowledge: Medicare is a complex program with multiple parts and options. To gain seniors' trust, you must have a thorough understanding of the various plans, coverage options, enrollment periods, and eligibility criteria. Be prepared to explain these intricacies clearly and simply. 2. Educational Approach: Seniors may be unfamiliar with the nuances of Medicare. Offer educational resources, seminars, or workshops to provide insights into how Medicare works, the differences between Part A, B, C, and D, and the potential out-of-pocket costs. Empower them to make informed decisions. 3. Personalized Consultations: Every senior's healthcare needs are unique. Schedule one-on-one consultations to assess their medical history, current health conditions, and prescription drug requirements. This information will help tailor your insurance recommendations to their specific needs.

4. Build Trust Through Transparency: Honesty and transparency are crucial. Clearly outline the benefits, limitations, and potential costs associated with each Medicare plan. Highlight any potential gaps in coverage and explain how supplementary insurance, such as Medigap or Medicare Advantage, can fill those gaps. 5. Address Affordability Concerns: Many seniors are on fixed incomes, so cost considerations are paramount. Explain the cost structures of different plans, including premiums, deductibles, co-pays, and out-of-pocket maximums. Discuss ways to manage costs while ensuring comprehensive coverage. 6. Communicate Effectively: Seniors may have varying comfort levels with technology. Offer multiple communication channels, including in-person meetings, phone calls, and printed materials. Adapt your approach to their preferences to ensure clear and effective communication.

7. Emphasize Preventive Care: Seniors often prioritize maintaining good health. Highlight Medicare's emphasis on preventive services, wellness visits, and screenings that can help them proactively manage their well-being. 8. Address Prescription Drug Coverage: Many seniors rely on prescription medications. Explain how Medicare Part D covers prescription drugs and discuss the importance of enrolling in a plan that aligns with their medication needs. 9. Simplify the Enrollment Process: The enrollment process can be overwhelming. Provide step-by-step guidance to help seniors navigate the paperwork and deadlines associated with Medicare enrollment.

10. Showcase Your Expertise: Highlight your experience and expertise in the Medicare insurance domain. Share case studies or success stories that showcase how your guidance has benefited other seniors. 11. Stay Up-to-Date: Medicare regulations and policies evolve. Stay informed about the latest updates and changes to ensure your advice is current and accurate. 12. Offer Post-Sale Support: Your relationship with seniors doesn't end after they enroll in a Medicare plan. Be available to address their questions, assist with claims, and provide ongoing support as their healthcare needs evolve. Selling Medicare insurance to seniors goes beyond selling a policy – it's about offering a compassionate service that enhances their quality of life. By demonstrating your deep understanding of their healthcare concerns, presenting clear options, and providing continuous support, you become a trusted partner in their healthcare journey. Remember, every interaction is an opportunity to make a meaningful difference in the lives of the seniors you serve.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage plans, medicare supplement insurance, Marketing, Best Practices

LeadStar Direct: High-quality Medicare Supplement, Medicare Advantage, and Final Expense leads

Posted by www.psmbrokerage.com Admin on Thu, Aug 10, 2023 @ 03:52 PM

Your new source for Direct Mail Leads

Why Direct Mail?Direct mail marketing to seniors offers distinct advantages by providing a targeted, personalized approach that leverages the familiarity and comfort of tangible communication, fostering trust and credibility while standing out amidst digital noise. It caters to a demographic less reliant on technology, allowing for a less competitive and more engaging channel that enables seniors to review information at their own pace, while also offering localized targeting and trackable response mechanisms to tailor campaigns effectively for enhanced engagement.

|

||||||||

| Newest Blog Posts | All Blog Posts | ||||||||

Tags: Insurance Marketing, direct mail, LeadStar

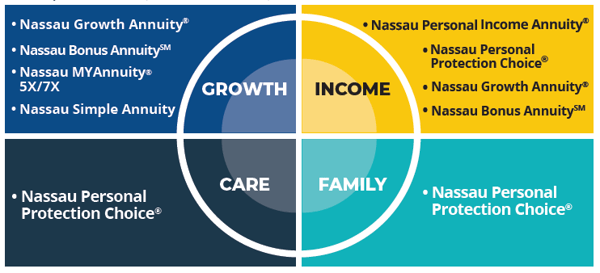

Nassau: Products for a broad range of needs

Posted by www.psmbrokerage.com Admin on Thu, Aug 10, 2023 @ 01:50 PM

|

At Nassau, their annuity portfolio is committed to providing comprehensive, customizable, and consistent retirement solutions.

Nassau Single Premium Fixed Indexed Annuity Product Suite Overview Nassau Personal Income Annuity® | Nassau Personal Protection Choice® | WORKING HARDER TO BE YOUR CARRIER OF CHOICE Not appointed with Nassau? Request details here |

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: Fixed Annuity, Nassau

New Medicare Marketing Rules Require Agents to Rethink Established Sales Practices

Posted by www.psmbrokerage.com Admin on Thu, Aug 10, 2023 @ 12:12 PM

|

“Medicare beneficiaries were at the center of the conversation when CMS enacted new marketing rules earlier this year. But with these changes agents may find they will need to pivot from their familiar marketing approach.” Good news: PSM anticipated these changes and activated a task force to study the published rules and clarify any implications for agents. More good news: With AEP a few short weeks away, agents have the tools to ensure your marketing efforts and activities are compliant with the new rules. Let’s look at the rules changes.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: CMS, Insurance Marketing, AEP

Introducing AdvantageGuard: A New Hospital indemnity Plan

Posted by www.psmbrokerage.com Admin on Thu, Aug 10, 2023 @ 12:12 PM

|

AdvantageGuard offers broad, customizable solutions for clients seeking easy and reliable hospital indemnity coverage. With guaranteed issue coverage options for seniors aged 60-741 and a focus on flexibility and affordability, AdvantageGuard makes it easy to find the help they may need with unexpected costs. Clients can choose the benefits that best fit their needs and budget, all backed by a insurer with an "A+" AM Best rating2. AdvantageGuard offers convenient cash benefits paid to the insured, making it a smart choice for clients who want help with covering out-of-pocket expenses, like their Medicare Advantage plan copays.

If you would like to get contracted to sell AdvantageGuard or other Golden Rule Insurance Company products, click here to get started. Precision Senior Marketing is an independent broker agency offering plans underwritten by Golden Rule Insurance Company and other insurers.

212-month Commission Advance is only available through YourFMO.com, LLC. contract 3Payable per day (limits apply) when Insured Person receives a prescription delivered by injection in an outpatient provider setting. 4Ratings as of 12/09/2022. This worldwide, independent organization reviews insurance companies and other businesses and publishes opinions about them. This rating is an indication of financial strength and stability. For the latest rating, access www.ambest.com. 49985-G-0723 Agents Only. Not Intended For Consumer Use.

|

|||

| Newest Blog Posts | All Blog Posts | |||

Tags: Hospital Indemnity, Medicare Advantage, AEP

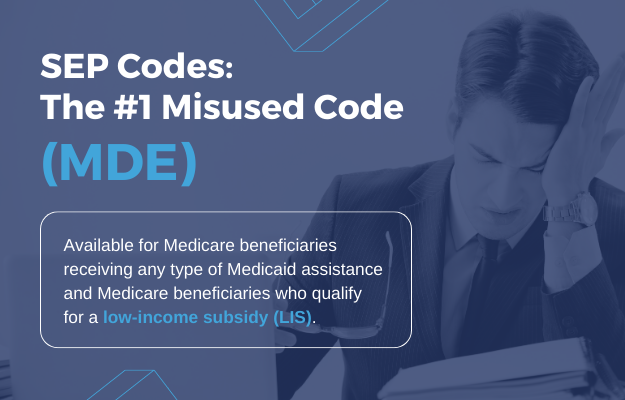

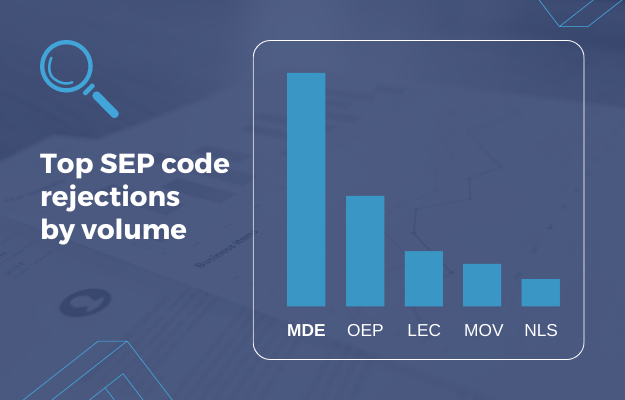

SEP Codes: The #1 Misused Code - MDE

Posted by www.psmbrokerage.com Admin on Wed, Aug 09, 2023 @ 11:55 AM

|

It has come to our attention that the MDE SEP is the #1 misused SEP. Misusing this SEP may cause CMS to reject the application and can be time consuming for all parties involved. It is very important that agents understand how to use SEP codes correctly to avoid having applications rejected and corrective action issued. SEP for Dual-Eligible Individuals and Other LIS-Eligible Individuals Available to:

If enrolled in:

When can it be used:

The effective date of an enrollment request made using this SEP is the first of the month following receipt of an enrollment request. The disenrollment date will be the end of the month in which the disenrollment request is received. Note: This SEP is separate from the “SEP for Individuals who Gain, Lose, or Have a Change in Their Dual or LIS-Eligible Status” and the two should not be used interchangeably.

|

||

| Newest Blog Posts | All Blog Posts |