|

||

|

Other Related Articles 7 Tips To Close More Insurance How to Decide What to Write on Your Insurance Blog |

Medicare Blog | Medicare News | Medicare Information

7 Ways to Grow Your Insurance Business

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:15 AM

Tags: Sales Strategies

7 Tips To Close More Insurance Sales

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:14 AM

7 Tips To Close More Insurance Sales

Closing sales isn't just about the words or tactics you use at the end of the sales process.

A strong close requires a foundation built throughout your sales process.

If you don't set yourself up properly before decision-making time, you aren't closing anything, you're simply selling with no direction.

If you are laying the groundwork properly you will have a trajectory through your sales process that will end up with a strong close that works for you and your customer.

Let's review some tips that can help you strengthen your closing game.

Section Links

⍟ Listen Intently

⍟ Remember, You’re Selling a Solution to a Problem

⍟ Use the Power of Stories

⍟ Limit Your Offer to a Few Good Options

⍟ Highlight the Value to Justify the Price

⍟ Ask the Right Questions and Let Them Close Themselves

⍟ Summarize Previously Agreed Upon Points

1 Listen Intently

Sounds stupid simple right?

While every salesman has ears, not every salesman knows how to listen. Often time they are rehearsing what they are going to say in their head and missing the cues their client is giving them.

It’s important when you meet a client to resist the urge to just jump right into a sales pitch explaining the reasons your prospect should consider a certain product.

It’s very important to remind yourself to avoid that urge and start simple. Start with listening and connecting.

Ask all the questions you need to ask in order to get to know your client better. Ask about their family, show them you are human and they are not just another sale to them.

When you get past the initial introduction and make your connection with your client, get them started with some simple questions that will allow them to explain their needs in regards to whatever type of insurance you may be discussing.

After all, that’s why you’re there, to discover their true needs and solve a problem for them. Give them time to speak and listen intently. Listen to everything they have to say without interruption, and watch their physical cues as well.

Listening intently will answer a lot of your questions upfront as well as inform you as to what type of objections they are stuck on if they haven’t told you directly.

2 Remember, you’re selling a solution to a problem

Once you’ve listened intently to your potential client you have a good idea of their needs. Or, at least, have developed a better set of questions to clarify the problem they are trying to solve.

When you have a good assessment of their needs, then you can start to find the pieces to the puzzle. Armed with this information you are better informed to look at the different product(s) to propose to your client.

Someone focusing on the sale from the word go may have taken the client's word that they are looking for a Med Supp and never would have learned that they could also benefit from Cancer, Heart Attack, and Stroke coverage.

Approaching your potential clients with a sales consultant strategy, you are positioned to earn their trust and better provide an offer that truly covers their unique coverage needs.

3 Use the power of stories

Storytelling is a powerful way to share any type of information. Human beings are hard-wired to take in information that is framed in a story.

Instead of just giving a list of benefits when discussing coverage, a story can lay out a situation that your client can identify with and better understand the benefits they can realize with a certain coverage.

When you create a story around a product your clients can imagine themselves in that scenario, experiencing the emotions that reveal a need for specific coverage.

While imagining your story they will feel the emotion of the situation and also the relief of having the coverage that could help them avoid a difficult situation.

When you use a story to illustrate something you can still go back to listing facts, figures, and the practical description of a product. Those facts will only enhance their understanding of the product now that they heard it framed in a story.

4 Limit your offer to a few good options

You can’t help but be amazed at the options we have all around us. Regardless of what you’re looking to purchase, it can be mind-boggling trying to choose from all the different options.

This can get even more overwhelming when we are shopping for something as important as insurance coverage.

We’ve all been there. Standing in a store staring at walls of similar products trying to figure out the differences, comparing price, assigning value, etc. Often time, we can’t make a decision so we walk away.

Remember that when you are presenting options to your clients. Ask the right questions to narrow down what their needs are and find the few best options that are best for their situation.

Give them a small number of choices that are truly a good fit and help them understand the benefits of each in simple language. Make sure they understand the options completely before asking them to move forward.

Don't get them bogged down in details. Do the work upfront and let them have an easier time making a choice. You will have greater success, and happier clients if you do.

5 Highlight the value to justify the price

It’s inevitable that the process of comparing products is going to lead to talk about the price. As you know, the price of anything is directly related to the perceived value of what is being paid for.

Hopefully, you have a process of helping your clients understand the clear value and benefits related to having a certain coverage.

Before you get to the stage of comparing costs, all of the benefits of and value of the coverage need to be laid out. Your client needs to have a clear sense of the value before they ever see a price.

It can be hard to explain the benefits in a way that fully appreciates the value that is provided.

This is where storytelling can work wonders. If you can trigger an emotional connection to the benefits coverage provides, you can better impart the true value involved.

6 Ask the right questions, let them close themselves

Before you can help your client you need to know your client.

Asking the right questions to better understand their needs will help you identify the right coverage for your client but it may also make your client aware of coverage needs they weren’t aware of.

By asking probing questions and reviewing what they mean to your client, you are walking them through the process of seeing the value of different types of coverage.

A skilled agent will go through this process and gain trust from their client because they recognize the agent is trying to solve their problem. Building trust in this way will make them more comfortable when it comes to reviewing options and suggestions you provide.

This will also help them uncover the value of the coverage for themselves, reducing any friction they might have.

Anytime you can lead a client to understand the value, as opposed to just telling them the value, you will have a much easier time closing the sale.

7 Summarize previously agreed-upon points

This is a simple and powerful technique that can be easily overlooked, or not quite used to its full effectiveness.

Throughout the process and steps we talked about in the above sections, you will have evoked emotion and hopefully even had a client recount a situation that is similar to the situation you created a story about.

You would have also asked questions like, “Mr. Brady, you’ve mentioned your family’s increased risk for cancer and heart attack, and are concerned about the possible costs of something like that occurring in your life. Would you be interested in seeing how a Cancer, Stroke, and Heart Attack Plan could fit into your coverage plan?”

When the client answers those types of questions they are closing themselves. Once they’ve done that you need to just summarize their agreement with the value you’ve already proved.

The perceived value you’ve described to your client is going to make accepting the cost of the coverage easier to swallow.

Conclusion

Closing is one of the most important skills you can develop. Although, It needs to be thought of in the context of your needs assessment.

Guide your clients through the process of understanding how different forms of coverage can help them by using stories to uncover their emotional connection to the coverage.

If you set up your conversation in the right way and ask the right questions upfront, closing becomes a whole lot easier.

Good luck and happy selling.

Back To Top

Other Related Articles:

A Young Insurance Agents Guide to Success

Selling Medicare Insurance Over the Phone

How to Decide What to Write on Your Insurance Blog

10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Provision

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:11 AM

|

At the start of the pandemic, Congress enacted the Families First Coronavirus Response Act (FFCRA), which included a requirement that Medicaid programs keep people continuously enrolled through the end of the month in which the COVID-19 public health emergency (PHE) ends, in exchange for enhanced federal funding. Primarily due to the continuous enrollment provision, Medicaid enrollment has grown substantially compared to before the pandemic and the uninsured rate has dropped. But, when the continuous enrollment provision ends, millions of people could lose coverage that could reverse recent gains in coverage. As part of the Consolidated Appropriations Act, 2023, signed into law on December 29, 2022, Congress set an end of March 31, 2023 for the continuous enrollment provision, and phases down the enhanced federal Medicaid matching funds through December 2023. States that accept the enhanced federal funding can resume disenrollments beginning in April but must meet certain reporting and other requirements during the unwinding process. This brief describes 10 key points about the unwinding of the Medicaid continuous enrollment requirement, highlighting data and analyses that can inform the unwinding process as well as recent legislation and guidance issued by the Centers for Medicare and Medicaid Services (CMS) to help states prepare for the end of the continuous enrollment provision.

|

||

Tags: Medicare Advantage, Medicare-Medicaid, Special Needs Plans

10 Reasons to Use E- Applications

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:01 AM

10 Reasons to Use E-Applications

Since the Coronavirus lock down, the ability to use e-applications has become a hot topic. The lockdown really highlighted the importance of being able to sell from home and complete applications online.

In an industry based on relationships, it is still possible to conduct business, successfully, and build trust with clients without meeting face-to-face.

There are still ways to connect with customers, such as: over the phone or via video call.

E-Apps give you the flexibility to not be right there with your customer but still be able to get a completed application from them.

Agents are starting to realize the many benefits of filling out applications online. This isn’t relegated to times of mandatory social distancing. There are good reasons agents should be using e-applications all the time, whether we have a quarantine situation or not.

E-apps are a great way to submit business. They are quick and easy for agents and clients alike, and can be signed electronically. An application that may take you 30-40 minutes by paper may take you just 10 minutes online.10 Reasons to Use E-Applications

1. E-Apps Are Quicker

E-apps are a much quicker way to do business. They aren’t just quicker to fill out, the time to process the applications is also sped up. In some cases, turnaround time for approvals can be decreased by up to 2 weeks.

2. Fewer Mistakes With E-Apps

There are far less mistakes with an online application, since the application can alert you if something is missed or input incorrectly.

3. Pre-Qualify your clients

You can pre-qualify your clients by answering required health questions. No waiting days just to find out if they qualify. Find out instantly with most carriers.

4. E-Apps Save Time

In addition to application and approval time savings there are more efficiencies agents gain by using this process. An agent will also benefit from the time not having to drive out to client’s homes as they would with paper applications, not to mention the associated costs of travel.

5. Serve More Clients With the Time You Save

The time gained by using online e-applications can now be put into dealing with more clients, increasing the number of applications that can be submitted compared to the old manual process.

6. Covid Has Made a Virtual Meeting a Friendly Option

People can be hesitant when it comes inviting a stranger into their home. This can make a virtual meeting and e-app option much easier to sell to clients.

7. Get Paid to Submit E-Apps

You heard that right. Most insurance companies are offering bonuses to agents when they use e-apps. Why are they doing this? Because they benefit from the efficiency of online applications just like everyone else does. As agents turn more and more to online applications it allows insurance companies to streamline their business around that process.

8. Quicker Underwriting Approval

Some carriers offer immediate underwriting approval. With these carriers you know on the spot if your client is declined. No more waiting for days just to find out the app was approved or not.

9. Complete Multiple Apps at Once

Some carriers such as Mutual of Omaha and Cigna (as of the date of this article) allow you to submit applications for different plans. Ex. A client that is looking for a Med Supp. and a cancer policy can be done in one pass without the redundant paperwork.

10. Get Paid More Quickly

Since the entire process of completing, submitting and approval of applications is quicker with e-apps, then you will obviously get paid quicker. Getting paid quickly means more money in your pocket in less time. Its hard to argue with those types of benefits.

Don’t think of handling applications online as a novel method to be used in just a few circumstances.

There is no reason not to be using e-apps as often as possible. Using e-applications is simply the best method available right now. It will benefit you, your clients and the carrier if you do.

As always , if you have any questions about the tools we have available to help you become more productive, our experienced marketers are here to help.

Tags: Online Enrollment

6 Tips To Improve Client Communication

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 10:58 AM

6 Tips to Improve Client Communication

(With Tips To Remain Compliant)

Your clients are trusting you to help them with some very important decisions.

It goes without saying that your clients are the backbone of your business. They could also be a continuing source of praise and referrals for years to come, if you treat them properly.

When I say “if you treat them properly”, the measure of that isn’t how well you think they were treated. If your client doesn’t feel like they were treated well, then they weren’t. It’s that simple.

When you meet a client for the first time there is a natural gap between the both of you. That gap is your lack of understanding of their needs and feelings.

The bridge to get you closer to your client is built with communication.

Below are some key aspects of communication that, if done properly, can help ensure you and your client will both benefit from your interactions.

Section Links

⍟ Be a Careful Listener

⍟ Be Ready to Ask the Right Questions at the Right Time

⍟ Be Empathetic

⍟ Be Honest & Transparent

⍟ Be Clear & Build Rapport

⍟ Be Consistent With Your Follow Up

⍟ Tips to Remain Compliant While Communicating With Clients

⍟ Be a Careful Listener

Sometimes the best way to listen is to allow a little pause after a client is done speaking. You don’t always need to respond. A space of silence can encourage your client to offer more of what they are thinking and feeling.

This will give you the best insight into what your client is thinking or what objections they may have.

Note: If you’re just nodding while thinking about what you’re going to say next, you aren’t listening.

" Most people do not listen with the intent to understand, they listen with the intent to reply. " - Stephen R. Covey

⍟ Be Ready to Ask the Right Questions at the Right Time

Powerful questions are your key to understanding the thoughts and emotion your clients are experiencing. The goal is to understand their fears, goals and desires.

The Powerful questios are those that allow you to understand the motivation behind your clients decisions.

These questions will vary depending on your business and your relationship with the client or prospective client.

⍟ Be Empathetic

Empathy is the ability to understand, be aware of and vicariously experience the feelings, thoughts and experience of another.

In order to put empathy into practice you will need to be able to resonate with another persons experiences. You will need to put yourself into a place where you can feel what they’re feeling (to some extent) and understand their situation from their point of view.

This is more than just a simple understanding of what they are going through and a pat on the back. If you can imagine yourself in the circumstance of a client, you should be able to appreciate what they are going through enough to reach a measure of the feeling they are experiencing.

If a client is becoming emotional about anything while you are trying to assess their needs and move them forward, just pause and give them space. Give them time to express themselves, and just listen.

At some point, the fact that you just listened for a time, while they vented, can be enough to get them back around to the issue at hand.

When a client shows a willingness to start discussing business, you have the green light to proceed.

If a client is overly emotional or using an excessive amount of your time in the process, It might be a good time to ask if they would like to re-schedule with you.

" Selling is not something you do to someone, it’s something you do for someone. " - Zig Ziglar

⍟ Be Honest & Transparent

This should be a given, and I almost didn’t include it since it should be so obvious.

Nevertheless, we continue to hear people complain about dishonest sales tactics, or outright lies. People today are skeptical by default. Get caught in a lie or hide information for your own benefit and it will come back to you.

Let’s be clear. Pretending you know something in order to avoid admitting you don’t is a lie. Leaving out important information that your client should know just to get a signature, with the intent to tell them later, or not at all, is dishonest.

In today’s environment, being honest and transparent is seen as a breath of fresh air. There is no reason to be dishonest.

No one is expecting you to be perfect. They will, however, reward you for being honest and acting with integrity.

⍟ Be Clear & Build Rapport

Whether you’re having a conversation in person or or via email, keep your discussions as clear, direct and specific as possible. Avoid over-explaining things when not necessary.

A key to great communication and being understood better by others is adapting your style to the person that you are speaking with.

Through careful listening, being empathetic, honest and truthful, your are building rapport with your client.

If your client uses a direct formal tone, respond in kind. If they are more casual and playful, respond similarly. This is the most direct way to get someone to understand you clearly.

This doesn’t mean that you have to be an entirely different person or change the way you are—but if you want your client to feel a stronger bond with you, you should adapt your communication style to fit theirs.

When you tailor your communication in this way you will find that you will have much more success being understood by your client.

" The reason it seems that price is all your customers care about is that you haven’t given them anything else to care about. "

- Seth Godin

⍟ Be Consistent With Your Follow Up

Good follow up is a big part of successful communication. Just because your client enrolled in a plan, doesn’t mean you can forget about them.

If they are confused or unhappy about anything concerning their choice you want to know about it. If you don’t, you can be sure the next agent that talks to them will, and you will no longer have that client.

While there may not be one perfect way to follow up for everyone, there are some general ideas that can help guide you.

For starters, don’t wait to make a follow up appointment with your clients. Follow up appointments should be scheduled at the initial appointment.

Let your client know that you would like to follow up with them and suggest a schedule. Whether that’s 3 days after the initial appointment, 30 days later, 60 days later, that’s up to you, just make sure you discuss it with your client so they agree to the schedule and know what to expect.

Always make it easy for your client to get in touch with you. Make it clear that they can contact you with any questions and give them at least 2 methods of contact.

Some agents send holiday and or birthday cards to their clients. This kind of gesture is up to you, but if others are doing it and you aren’t, what will your clients think when they see a friend get a card from their agent wishing them well for the holidays?

⍟ Tips to Remain Compliant While Communicating With Clients

It’s important to keep compliance in mind with everything you do as an agent. As I’m sure your aware, there are a couple rules to communicating with prospective clients.

We will outline some for reference, but please check with the Medicare Communications and Marketing Guidelines and keep up with Medicare related news for updates. There are many stipulations that depend on your specific situation and they tend to change.

First, let’s mention the Scope of Appointment (SOA). Before you make an in person visit with someone you need to complete an SOA form.

For more specific details on how to complete a Scope of Appointment, see our blog on Scope of Appointment.

Remember, It is now allowable for an agent to contact someone via email without an SOA, as long as you have an opt-out function. For more see our article on Medicare Communications & Marketing Guidelines.

Don’t forget to ask for referrals! Especially since it is now allowed by the Medicare Communications and Marketing Guidelines, on a one on one appointment.

⍟ The Final Say

There are many techniques and schools of thought on communication. This is one them.

I think it covers some of the important bits. Through experience and practice you will find your own groove. Keep what works but don’t stop learning and trying new things.

We are always learning more about the human mind and how it works. That will inform how people are influenced, and therefore, how you can best reach them.

And, of course, the rules and regulations will continue to evolve.

You must be aware of those regulations if you want to have the opportunity to keep communicating with prospective clients.

If you have any questions, as always, our experienced marketers are here to help.

Happy selling.

" The difference between try and triumph is just a little umph. " - Marvin Phillips

Back To Top

Other Related Articles

Medicare Communication and Marketing Guidelines

How to Decide What to Write on Your Insurance Blog

Tags: Sales Strategies

What should you expect working with an Annuity IMO

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:25 PM

|

AN IMO/FMO specializing in annuities is a key player in the insurance and financial services industry, serving as an intermediary between insurance carriers or financial institutions and independent agents or financial advisors. An Annuity IMO offers critical support to agents and advisors focused on selling annuities, which are financial products designed to provide a stream of income for clients during retirement. Here are the primary functions and roles of an Annuity IMO: Product Expertise: Provide agents and advisors with in-depth knowledge about various types of annuities, such as fixed annuities, variable annuities, and indexed annuities. This knowledge enables agents to assist clients in selecting the most suitable annuity products. Carrier Contracts: Assist agents in contracting with multiple insurance carriers or financial institutions that offer annuities. This broadens the range of annuity products agents can offer to clients. Education and Training: Offer ongoing education and training programs to ensure agents stay current with the latest annuity products, regulations, and sales techniques. Sales Support: They often provide marketing materials, sales tools, and guidance on effective strategies for selling annuities. Commission Management: They assist agents in tracking and managing commissions, ensuring agents are fairly compensated for their sales efforts. Compliance Assistance: Help agents navigate regulatory requirements and compliance issues related to annuity sales. Market Insights: They may provide agents with market insights, trends, and data to help them make informed decisions and adapt their sales strategies to changing market conditions. Client Support: Some offer post-sale support to clients, helping address their questions and concerns related to their annuity contracts. An Annuity IMO plays a crucial role in helping agents and advisors serve their clients by offering comprehensive product knowledge, compliance guidance, marketing support, and a broad range of annuity options. This support benefits both the agents and their clients by ensuring that annuity sales are conducted ethically and professionally, leading to well-informed investment decisions for those seeking retirement income solutions. Check out our Agent Programs and Services Guide to learn more about PSM and the services we proudly offer the agents we work with.

|

Guide to Selling Final Expense Insurance

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:23 PM

|

Tags: Final Expense, Guide

Start Selling AdvantageGuard Today

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:22 PM

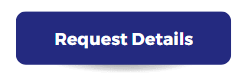

Start selling AdvantageGuard today!

Your client's new option for help covering Medicare Advantage plan copays Clients can choose the benefits that best fit their needs and budget, all backed by a insurer with an "A+" AM Best rating2. AdvantageGuard offers convenient cash benefits paid to the insured, making it a smart choice for clients who want help with covering out-of-pocket expenses, like their Medicare Advantage plan copays. Request details today and start offering this new plan to your clients. Precision Senior Marketing is an independent broker agency offering plans underwritten by Golden Rule Insurance Company and other insurers.

212-month Commission Advance is only available through YourFMO.com, LLC. contract 3Payable per day (limits apply) when Insured Person receives a prescription delivered by injection in an outpatient provider setting. 4Ratings as of 12/09/2022. This worldwide, independent organization reviews insurance companies and other businesses and publishes opinions about them. This rating is an indication of financial strength and stability. For the latest rating, access www.ambest.com. 49985-G-0723 Agents Only. Not Intended For Consumer Use.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Hospital Indemnity, Medicare Advantage, AEP

What should you expect working with a Medicare FMO

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:05 PM

|

A Field Marketing Organization (FMO) in the context of Medicare serves as an intermediary between insurance carriers and insurance agents or brokers specializing in Medicare insurance products. The primary focus of a Medicare FMO is to support and assist agents in selling Medicare-related insurance plans, which include Medicare Advantage (Part C) plans, Medicare Prescription Drug Plans (Part D), and Medicare Supplement (Medigap) plans. Here are the key functions and roles of a Medicare FMO:

In essence, a Medicare FMO serves as a valuable resource and support system for insurance agents, allowing them to serve clients more effectively and provide the information and services required to make informed choices regarding Medicare plans. It benefits both agents and beneficiaries by ensuring a smoother and more informed enrollment process. With approximately 10,000 individuals in the United States becoming eligible for Medicare each day, finding the right Field Marketing Organization (FMO) to partner with is crucial for achieving success. PSM goes above and beyond to empower independent agents, agencies, and brokers by offering unparalleled insurance products, exceptional back-office support, and a wealth of valuable tools and resources.Check out our Agent Programs and Services Guide to learn more about PSM and the services we proudly offer the agents we work with.

|

Tags: FMO, Medicare FMO

Customized Promotional Medicare Flyers

Posted by www.psmbrokerage.com Admin on Thu, Oct 19, 2023 @ 04:35 PM

|

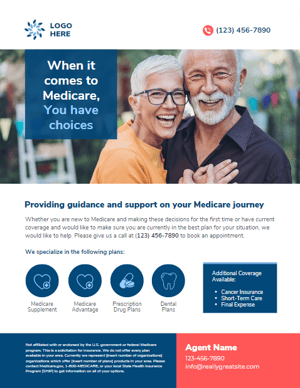

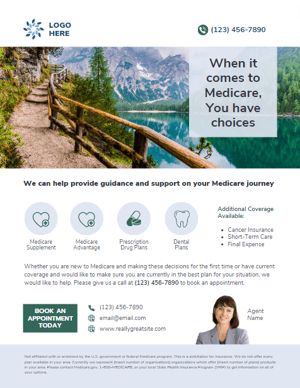

Looking for pre-approved Medicare Flyers you can customize with your personal information? Well look no further! PSM offers an array of promotional materials to help you stand out in the Medicare market.

|

||||

.png?width=400&height=400&name=Learn%20MORE%20(1).png)