|

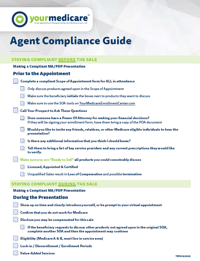

This guide was developed to aid compliance throughout all stages of the sales process and includes critical information and useful tips to keep in mind at all times. Making a Compliant MA/PDP Presentation Featuring a handy check list, presentation phases are covered in three sections: Prior – Key points

During – Necessary steps

After – Important follow-up actions

Things to Know

In addition to the preceding information, the compliance guide addresses the following topics:

Download the Compliance Guide here!  |

||||

Medicare Blog | Medicare News | Medicare Information

Agent Compliance Guide: Staying Compliant Before the Sale

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:18 AM

|

|

A Guide for Agents Who Want to Learn How to Become Certified and Sell Medicare Advantage Plans

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:18 AM

|

It’s no secret that Medicare Advantage (MA) plans are the fastest growing segment of the Medicare market. MA enrollment increased by 10% since last year – continuing a 14-year growth trend – to reach an estimated 22 million people. From just 13% of new enrollees in 2004, MA’s market share has grown to more than 34% today and is projected to reach 42% by 2028. As more senior clients vote with their checkbooks – in favor of MA plans – many of the top senior-focused agents are taking steps to add Medicare Advantage plans to the product portfolio. ____________ ⍟ What are MA Plans? ⍟ Why are MA Plans Becoming so Popular? ⍟ Why Do Some Agents Hesitate to Sell MA? ⍟ The Path to Becoming an MA Agent

What are Medicare Advantage plans? The Center for Medicare and Medicaid Services (CMS) describes MA as an “all-in-one alternative to Original Medicare,” bundling Medicare Part A, Part B, and usually Part D in a single plan. “Some plans may have lower out-of-pocket costs than Original Medicare,” CMS says, and “some plans offer extra benefits that Original Medicare doesn’t cover - like vision, hearing, or dental.” Both Medicare Supplement and MA plans:

Only MA Plans:

Why are MA plans becoming so popular?

All the signs are positive for the MA market:

Why is it that some retiree-focused agents hesitate to sell MA Plans?

Some brokers and agents have perceived issues with MA plan features. Even more have resisted due to the perceived hassle of obtaining the certification they need to sell MA plans. Let’s analyze each of these concerns. Perceived issues with MA plans, in many cases, turn out to be “non-issues”

The path to becoming an MA agent is straightforward.

Here are the simple steps for you, the agent, to follow:

All the trends - the regulatory changes being advocated by HHS and CMS leadership, the demographics, the positive health outcomes for beneficiaries – point toward continued growth and popularity for Medicare Advantage plans. Increasingly, clients and prospects are going to want to work with agents who provide complete Medicare solutions, and that means being equipped to offer access to MA plans. Top agents are finding that it is well worth the extra effort to jump into this large and rapidly growing market. If you are interesting in pursuing the Medicare Advantage market, please reach out to one of our Marketing Directors and they will gladly assist with everything you need. We appreciate your time and the opportunity to assist in growing your Medicare business. Email: info@psmbrokerage.com

|

||

Tags: Medicare Advantage

10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Provision

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:11 AM

|

At the start of the pandemic, Congress enacted the Families First Coronavirus Response Act (FFCRA), which included a requirement that Medicaid programs keep people continuously enrolled through the end of the month in which the COVID-19 public health emergency (PHE) ends, in exchange for enhanced federal funding. Primarily due to the continuous enrollment provision, Medicaid enrollment has grown substantially compared to before the pandemic and the uninsured rate has dropped. But, when the continuous enrollment provision ends, millions of people could lose coverage that could reverse recent gains in coverage. As part of the Consolidated Appropriations Act, 2023, signed into law on December 29, 2022, Congress set an end of March 31, 2023 for the continuous enrollment provision, and phases down the enhanced federal Medicaid matching funds through December 2023. States that accept the enhanced federal funding can resume disenrollments beginning in April but must meet certain reporting and other requirements during the unwinding process. This brief describes 10 key points about the unwinding of the Medicaid continuous enrollment requirement, highlighting data and analyses that can inform the unwinding process as well as recent legislation and guidance issued by the Centers for Medicare and Medicaid Services (CMS) to help states prepare for the end of the continuous enrollment provision.

|

||

Tags: Medicare Advantage, Medicare-Medicaid, Special Needs Plans

Start Selling AdvantageGuard Today

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:22 PM

Start selling AdvantageGuard today!

Your client's new option for help covering Medicare Advantage plan copays Clients can choose the benefits that best fit their needs and budget, all backed by a insurer with an "A+" AM Best rating2. AdvantageGuard offers convenient cash benefits paid to the insured, making it a smart choice for clients who want help with covering out-of-pocket expenses, like their Medicare Advantage plan copays. Request details today and start offering this new plan to your clients. Precision Senior Marketing is an independent broker agency offering plans underwritten by Golden Rule Insurance Company and other insurers.

212-month Commission Advance is only available through YourFMO.com, LLC. contract 3Payable per day (limits apply) when Insured Person receives a prescription delivered by injection in an outpatient provider setting. 4Ratings as of 12/09/2022. This worldwide, independent organization reviews insurance companies and other businesses and publishes opinions about them. This rating is an indication of financial strength and stability. For the latest rating, access www.ambest.com. 49985-G-0723 Agents Only. Not Intended For Consumer Use.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Hospital Indemnity, Medicare Advantage, AEP

Wellcare and Mutual of Omaha - A new opportunity for MA sales

Posted by www.psmbrokerage.com Admin on Mon, Oct 09, 2023 @ 02:03 PM

|

Mutual of Omaha and Wellcare have formed a strategic alliance to offer jointly designed Medicare Advantage plans in select markets for the 2024 plan year. They are excited to offer this meaningful addition to their portfolio of senior health solutions designed to meet customers' individual needs. To learn more, including where plans will be available, please request details today and one of our marketing representatives would be happy to share the information. Two leaders in the senior health market - Mutual of Omaha and Wellcare have formed a strategic alliance to offer jointly designed Medicare Advantage plans in select markets for the 2024 plan year. As a customer-focused company, Mutual of Omaha is committed to offering a comprehensive suite of senior health products. Medicare Advantage plans offered with Wellcare are a meaningful addition to our portfolio of senior health solutions designed to meet customers' individual needs.

For Agent Use Only. Not to be shared with Medicare beneficiaries A trusted brand among seniors with 95% brand awareness, Mutual of Omaha is the nation's second-largest provider of Medicare Supplement plans. Our company remains committed to the Medicare Supplement market and plan to continue to grow in this space. Our senior health solutions portfolio also includes prescription drug (Part D), dental and vision coverages. Wellcare and Mutual of Omaha will offer No Premium and Low Premium MAPD PPO cobranded plans in Georgia, Missouri, South Carolina, and Washington state as well as in Dallas/Fort Worth and Houston markets in Texas. The jointly marketed plans will be offered during this fall's Medicare Annual Enrollment Period (AEP) which begins Oct. 15 and runs through Dec. 7th. The customer experience, including customer service, enrollment, and member communications, will be the Wellcare experience. All sales and brokerage operations will be handled by Wellcare. All 2024 contracted and certified Wellcare brokers will automatically have access to the co-branded plans with the same compensation model. We are excited to offer this new opportunity to you and your clients. Be on the lookout for more information as we showcase the plans and the opportunities in each market.

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, Mutual of Omaha Medicare Supplement, dental plans, WellCare

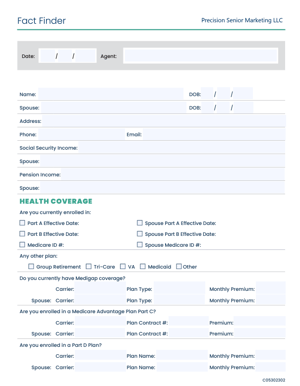

Benefits of Using a Client Needs Assessment Form

Posted by www.psmbrokerage.com Admin on Wed, Oct 04, 2023 @ 12:24 PM

|

Want a custom version with your info and logo? Inquire with your Marketing Representative today and we would be happy to accommodate! Step 1 - Collecting information through a CNA for all your clients is the optimal method to guarantee your ability to offer coverage options and plan selections that align with their present circumstances. Step 2 - Engage in the CNA process to gain insights (or refresh your understanding) into your client's Medicare eligibility, existing coverage, and their primary concerns regarding their healthcare coverage. Step 3 - Utilize the details gathered from the CNA, along with your discussion, to introduce potential plan choices that align with their particular requirements. _____________ By analyzing the assessment form, insurance agents can identify potential coverage gaps in a client's current or desired plan. This allows agents to suggest supplemental plans to fill those gaps. By involving clients in the assessment process, insurance agents educate them about different coverage options, and potential out-of-pocket costs. This empowers clients to make informed decisions about their healthcare.

|

||

|

|

Tags: Medicare Advantage, Medicare Supplement, Medicare Part D, Professional Networking, Marketing

Medicare Scope of Appointment Form Download

Posted by www.psmbrokerage.com Admin on Wed, Sep 27, 2023 @ 02:14 PM

|

The Scope of Appointment (SOA) process is a crucial aspect of Medicare marketing and sales activities designed to protect the interests of Medicare beneficiaries and ensure compliance with regulations. The SOA process is primarily associated with Medicare Advantage (Part C) and Medicare Prescription Drug Plans (Part D) but can also apply to other Medicare-related products. Here's an overview of the Medicare Scope of Appointment process:

|

|||||

Tags: Online Enrollment, Medicare Advantage, Part D, Scope of Appointment, SOA

|

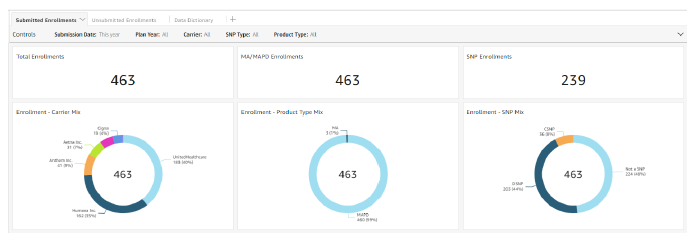

Agent Reporting Agents will have visibility into their production since January 1, 2023. To access this new function, click the graph icon on the left side of your screen and select the “Performance” tab at the top.

This report will showcase:

|

|||||

Tags: Online Enrollment, Medicare Advantage, Medicare Supplement, Part D, SunFireMatrix

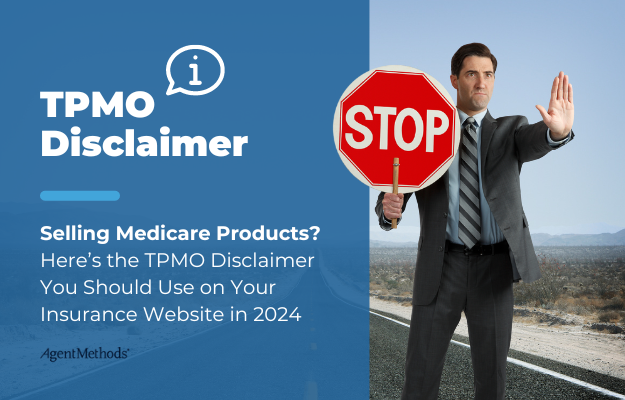

Medicare Marketing Changes in 2024: New TPMO Disclaimer

Posted by www.psmbrokerage.com Admin on Wed, Aug 30, 2023 @ 10:44 AM

|

Yes, we feel your pain. It seems like every year there’s a new set of compliance rules that agents must follow when selling Medicare Advantage and Part D plans. Some are a minor nuisance; others require scrambling to find and put new systems in place before the deadline (call recording, anybody?). Remember why CMS does this: They are trying to protect Medicare beneficiaries against misleading and confusing sales and marketing tactics, and make sure these consumers get the right help to end up with the appropriate plan for their needs. This is the same goal that most independent agents have when selling Medicare plans. While most independent agents focus on providing the best service possible, there are some bad actors. According to CMS, the number of consumer complaints rose from 15,497 in 2020 to 39,617 in 2021. Medicare Marketing Changes in 2024: New TPMO DisclaimerThere are many resources you can turn to that dive into the changes for 2024. We won’t go over all of them here. But there is one specific rule that directly affects AgentMethods’ customers and the service we provide: the TPMO (Third Party Marketing Organization) Disclaimer. To make sure it’s clear to customers what companies and plans an agent can offer them, CMS has provided an updated TPMO disclaimer that agents must use in communication and marketing materials such as email, online chat, advertisements, and websites. The new disclaimer is: “We do not offer every plan available in your area. Currently, we represent [insert number of organizations] organizations which offer [insert number of plans] plans in your area. Please contact Medicare.gov, 1–800–MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.” (source: https://www.ecfr.gov/current/title-42/part-422/subpart-V#p-422.2267(e)(41)) But there’s one tiny problem with the new disclaimer… The New Disclaimer Doesn’t Work on WebsitesWhile this new disclaimer is helpful for direct mail campaigns and one-on-one communications, it creates a problem when communicating with anonymous website visitors who don’t know their local area. In that case, you aren’t able to provide a correct number for organizations you work with and plans you offer within their area. We are seeing creative solutions, such as:

|

|||||

Tags: Medicare Advantage, Part D, Compliance, TPMO, AgentMethods

We are excited to announce the initial launch of SunFire’s Med Supp Quoting and Enrollment Experience

Posted by www.psmbrokerage.com Admin on Wed, Aug 30, 2023 @ 08:52 AM

|

We are excited to announce the initial launch of SunFire’s Med Supp Quoting and Enrollment Experience, arriving 10/1! We believe they have created a revolutionary platform that will significantly improve your efficiencies and profitability. As with any new product, their goal is to build a strong foundation with key features and continue to enhance the system over time, including additional carrier integrations. Features Included in the Initial Launch

|

|||||

Tags: Online Enrollment, Medicare Advantage, Medicare Supplement, Part D, SunFireMatrix

.png?width=625&height=330&name=How%20to%20Sell%20Medicare%20Advantage%20%26%20Medicare%20Supplement%20Over%20the%20Phone%20(11).png)