|

Insurance agents can have successful careers building a significant client base by selling Medicare Advantage (MA) coverage to beneficiaries. Agents wanting to expand their business beyond MA coverage and move their earnings to new levels can do that holistically with ancillary products. Along with the potential for increased revenue, agents cross-selling ancillary products could help their clients save money on health care expenses while setting themselves apart from the competition.

One cross-selling technique is packaging MA and ancillary products as a bundled approach. This minimizes the likelihood of clients seeking alternative coverage options,

which increases their long-term commitment to their agents and their carriers. The key isn't only knowing all available products and coverage benefits, but how they compliment MA coverage to best meet your client’s needs.

It’s important to remember that cross selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non health related product (such as life or home insurance or financial planning services). This activity is prohibited during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials (such as the “Enrollment Guide”) to consumers.

Let’s breakdown the three most popular ancillary products.

HOSPITAL INDEMNITY PLANS

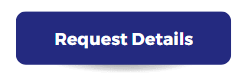

Hospital Indemnity (HI) plans provide Medicare beneficiaries with financial protection for medical expenses associated with daily hospital confinement, ambulance rides, diagnostic tests, lab work and prescription medications.

Agents can share with clients that the plans are designed to supplement other health insurance policies and can cover deductibles, copayments and other out-of-pocket costs. HI policies don't have network restrictions, meaning policyholders can choose providers that are both in and out-of-network. Networks become very important, especially when a person wants treatment at the best facility available after a diagnosis of a critical or complex disease, such as cancer, renal failure or heart disease. An added benefit: many HI plans come with riders, such as coverage for cancer costs, emergency room visits and outpatient services.

FINAL EXPENSE PLANS

Final Expense (FE) policies provide clients with a sense of security for their loved ones and protect them from unforeseen costs associated with medical bills and funeral costs. With the right guidance and product knowledge, agents can provide their customers

with quality coverage at affordable rates. Clients would be interested in knowing that

FE qualification thresholds are usually much lower than for other life insurance policies

regarding a policyholder’s health.

Agents can also stress that FE products go beyond burial costs and can include leaving financial gifts for clients’ family members that can go to settling debts.

DENTAL, VISION AND HEARING (DVH) PLANS

Dental, Vision and Hearing (DVH) coverage can increase a client’s financial protection

beyond what is available through traditional MA plans. Agents can let clients know that as they age, they are at a higher risk of needing DVH-related care. DVH plans offer additional access to coverage for these unexpected costs not covered by some Medicare plans.

TAKING ADVANTAGE OF THE ANCILLARY MARKETPLACE

The ancillary marketplace lets agents leverage their already-existing client base and build longer-term relationships with them through cross-selling opportunities. Once agents are comfortable with selling MA products, they can take the following steps to move into the ancillary marketplace:

- Learn about the available products and coverage benefits.

- Do the homework and uncover how ancillary products can complement clients’ current coverage.

- With recent changes in CMS guidelines, it’s important to understand their impact on cross-selling opportunities. Ensure you understand all government, state and local regulations.

- Contact your clients and holistically market these plans. Agents who want to grow their business beyond Medicare products would be well advised to consider the holistic nature of ancillary products. These plans can diversify their product portfolios and maximize their earnings while providing their clients with added protections from unanticipated medical costs.

-

“Cross-selling occurs when an opportunity to sell a Medicare plan is also utilized to sell a non-health related product (such as life or home insurance or financial planning services). This activity is prohibited by CMS during individual appointments, marketing/sales events or when providing Medicare plan enrollment materials to consumers. Review the current Medicare Advantage Marketing Regulations and make sure you’re complying with Medicare’s rules regarding cross-selling.”

*For Agent use only. Not affiliated with the U. S. government or federal Medicare program.

RESOURCES:

|